The science journal Nature recently published a paper regarding the positive progress of scientists working on a universal cancer vaccine. If such a vaccine were ever created, it would obviously have immense implications—not the least of which is longer, healthier lives for Canadians.

In light of this news, let’s consider what impact a cure for cancer could have on the longevity of Canadian pension plan members, as well as the financial implications for defined benefit pension plan sponsors.

Cancer and Canadian longevity

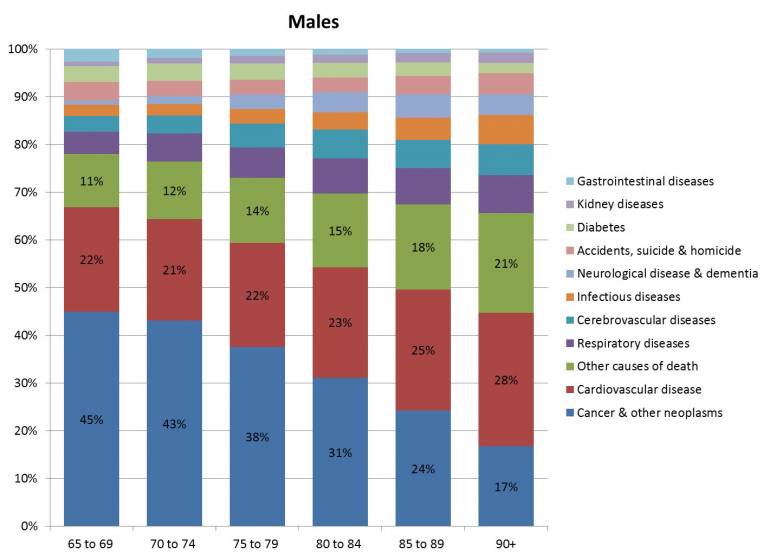

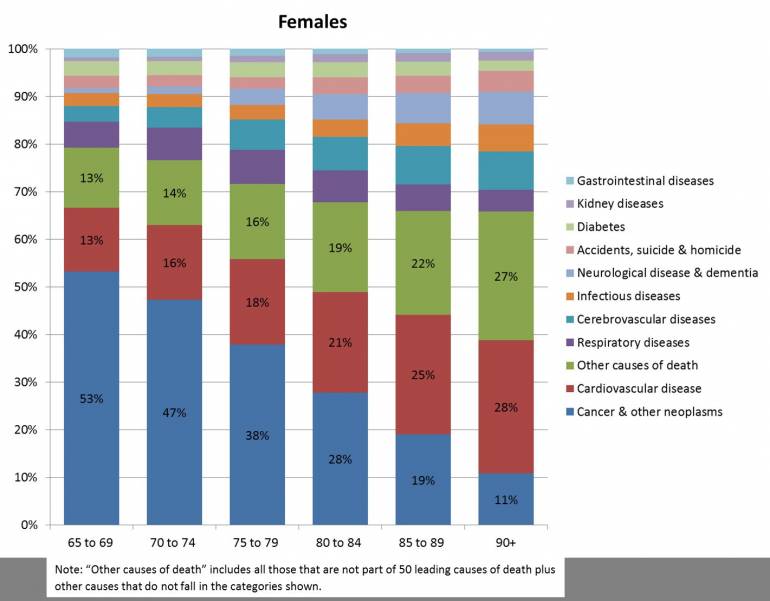

First, we need to understand how cancer currently impacts how long Canadians live. The charts below show the relative proportion of deaths attributable to different causes for Canadian males and females age 65 and older (based on 2012 data published by Statistics Canada).

About 40% to 50% of deaths for both males and females ages 65 to 74 are attributed to cancer, with this proportion decreasing to about 30% to 40% for those ages 75 to 84. It’s not until we get to those 85 and older that cardiovascular disease takes over from cancer as the leading cause of death. While cancer has been a significant cause of death for some time, its relative significance has been increasing as the incidence of cardiovascular disease decreases.

Impact on pension plan liabilities

One simple way to assess the impact of a cure for cancer on pensioner longevity is to assume all deaths caused by cancer are immediately eliminated. Based on the results shown in the charts above, this would result in 53% fewer deaths for Canadian females ages 65 to 69, 47% fewer for those ages 70 to 74, and so on.

If this happened, there would be an increase in life expectancy at age 65 of approximately 2.6 years for males and 2.2 years for females. Given that a one-year increase in life expectancy typically equates to a 3% to 4% increase in pension liabilities, a cure for cancer in this scenario could potentially increase pension liabilities by 7% to 10%.

In reality, the implications of a cure for cancer aren’t so easy to assess. For example, progress to date has generally been focused on specific forms of cancer as opposed to all cancers. In addition, if cancer is removed from the equation, there will be more deaths from other causes. This is particularly true at older ages, as individuals begin to have multiple health and medical issues.

A cure for cancer wouldn’t have an immediate impact, since it would take time to perform the required testing, obtain approvals, develop and distribute. However, once such a breakthrough occurred, it would only be a matter of time before pension plans would need to reflect the associated improvements in lifespans (some of which would be the acceleration of improvements assumed to occur in the future).

Although there is still much work to be done in the fight against cancer, this potential universal cancer vaccine is a reminder that pension plan sponsors and their actuaries need to think carefully about what the future may hold for Canadian lifespans.