VitalStatistics

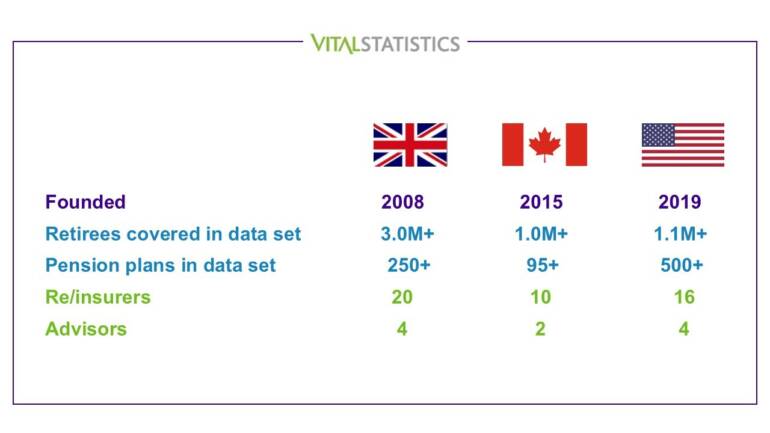

Over 500 leading DB pension funds pool their data through Club Vita in either the UK, US or Canada.

Our data sets now cover over 1 in 4 UK DB pensioners and 1 in 4 Canadian DB pensioners, with US data gathering rapidly catching up.

Our models are fast becoming the industry’s common currency with over 40 re/insurance users and 10 pension/insurance advisory firms using Club Vita worldwide.

"Data drives pricing"

Find out more

Find out how our unparalleled insights can benefit your plan