Ground-breaking results from Club Vita Canada reveal some DB pension plans are overestimating their liabilities

21 February 2017

TORONTO – New research finds longevity for Canadian pensioners is lower than anticipated – which may actually be costing DB plan sponsors.

Canadian male pensioners are living about 1.5 years less than expected from age 65, according to the latest data from Club Vita Canada Inc. – the first dedicated longevity analytics firm for Canadian pension plans and a subsidiary of Eckler Ltd. Female pensioners are living about half a year less than expected.

"Based on our data, some DB plans are overestimating how long their members are currently living and are therefore taking an overly conservative approach to funding their liabilities,” explains Ian Edelist, CEO of Club Vita Canada. “Correcting that overestimation could reduce actuarial reserves by as much as 6% – improving Canadian pension funds’ and their plan sponsors’ balance sheets just by using more accurate, granular and up-to-date longevity assumptions."

The data comes from Club Vita Canada’s first annual and highly successful longevity study completed in 2016 – one of the largest, most rigorous research studies on the impact of longevity on defined benefit pension and post-retirement health plans.

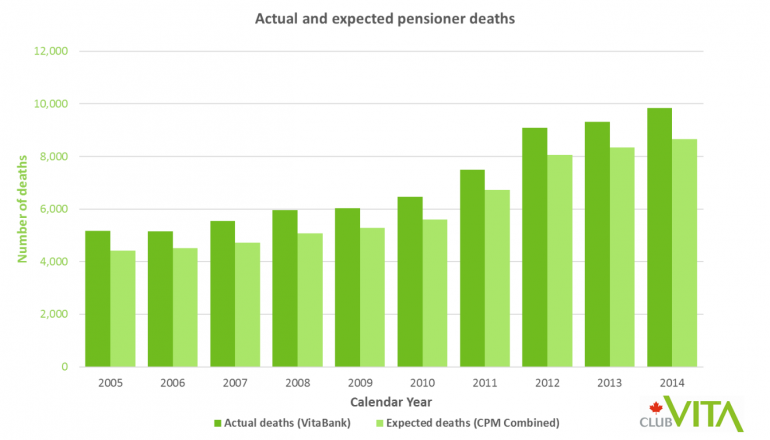

The newly created “VitaBank” pool of longevity data (provided by Club Vita Canada members) spans a wide range of industries and geographic regions in both the public and private sectors. VitaBank is currently tracking more than 500,000 Canadian pensioners from over 40 pension plans. Unlike the most widely used study to set longevity expectations – the Canadian Pensioners’ Mortality (CPM) study, which relies on data up to 2008 – VitaBank includes fully cleaned and validated data up to 2014.

The Club Vita study brings to the Canadian pension market leading-edge modelling techniques already used by the insurance industry and in other countries. Club Vita U.K. recently released similar results, noting £25 billion could be wiped off the collective U.K. DB deficit by using more accurate longevity assumptions.

“Naturally, the ultimate cost of a pension plan will be determined by how long its members actually live. But assumptions made today really do matter for such long-duration commitments,” explains Douglas Anderson, founder of Club Vita in the U.K. “Club Vita’s data gives DB plan sponsors the tools they need to evaluate their willingness to maintain their longevity risk or offload that risk to insurers.”