In this regular column, Club Vita’s longevity experts will help you visualise the often abstract world of longevity risk by introducing some of their favourite charts.

In this edition of Top Charts, Saeed Ahmadi looks at what proportion longevity makes up of the total funding risk of pension plans in Canada.

Question:

What proportion does longevity make-up of the total funding risk of pension plans in Canada?

Answer:

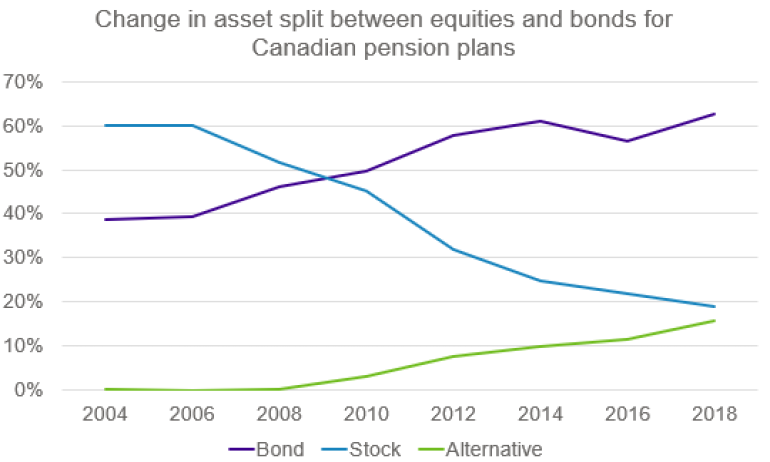

Over the past 15 years, pension plans in Canada have tended to reduce their exposure to asset risk and hedge their exposure to volatility in funding yields. In fact, a recent study by Bank of Canada shows that about 64% of Defined Benefit (DB) pension plans have shifted their asset allocation more toward bonds (and away from equities) between 1998 and 2018. A similar de-risking pattern was also observed among defined benefit pension plans in the UK as highlighted here .

Change in asset split between equities and bonds for Canadian pension plans

Source: Office of the Superintendent of Financial Institutions pension fund data. Details of portfolio shift metric can be found in the Bank of Canada analytical note available here .

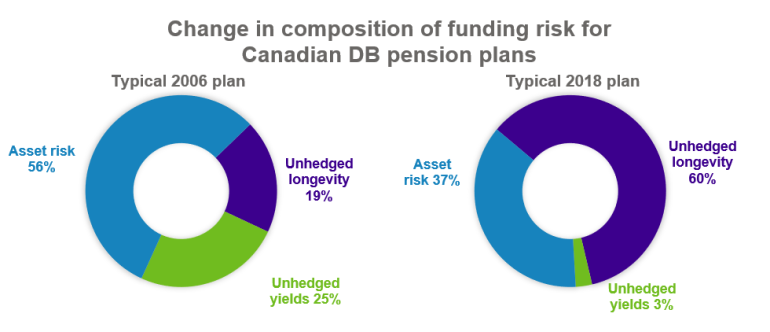

This has left longevity risk as the largest remaining unhedged risk; in fact, the remaining unhedged longevity risk can potentially make up over 60% of the total funding risk.

Change in composition of funding risk for Canadian DB pension plans

Source: Club Vita analysis based two hypothetical plans. Charts have been provided for illustration purposes only.

Typical 2006 plan

- 80% funded with 65% pensioners & 35% non-pensioners to represent a mature underfunded plan

- 60% equities and 40% bonds, with the bonds having an interest/inflation exposure matching the liabilities

Typical 2018 plan

- 100% funded with 70% pensioners & 30% non-pensioners to represent the same plan a few years later after the plan has further matured

- 20% equities and 80% bonds to capture that the plan has de-risked their asset mix systematically over this time

Key takeaways

- The reduction of asset risk and hedging of volatility of funding yields over the last 15 years means that longevity risk is now the largest unhedged risk for pension plans in Canada.

- Longevity risk could make up over 60% of the total funding risk of a pension plan depending on the asset mixed and riskiness of the portfolio.

- There is clearly a need for affordable and easily transactable longevity risk protection

The key questions is: How should pension schemes most effectively hedge this longevity risk?

What do you think?

What do you think?

Let us know your thoughts and comments on this publication on our Friends of Club Vita LinkedIn Group