13 December 2017

Defined benefit (DB) pension plan sponsors have become well versed in the art of de-risking over the past decade. Whether it’s converting to defined contribution (DC) plans, evolving investment strategies, developing glide-paths or annuitizing inactive members, risk mitigation has become ingrained in the Canadian DB pension industry. But despite this evolution, there is one risk that hasn’t yet received its fair share of attention: longevity risk.

The reference to longevity risk is important, since DB plan sponsors are very familiar with the need for longevity assumptions – particularly the fact that plan members have continued to live longer than expected, resulting in revised assumptions and unexpected increases in liabilities. But longevity risk is much more than an assumption. Unlike stocks and bonds, there aren’t market indices available to assess longevity volatility, and the characteristics of longevity risk are fundamentally different from those of investment and interest rate risk.

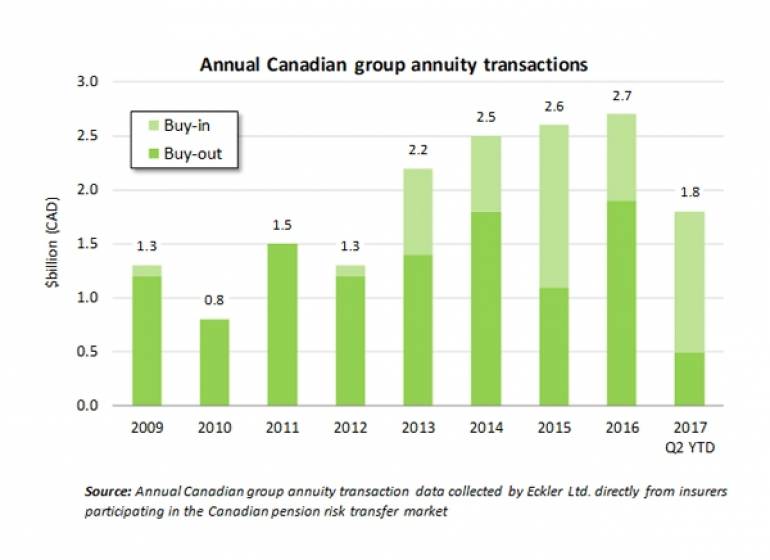

Despite the lack of focus on longevity risk, many plan sponsors have taken steps to mitigate their exposure. For example, some have moved to DC plans, effectively transferring longevity risk to individual plan members. Increasingly, DB plan sponsors are transferring all risks associated with groups of plan members – including longevity – to insurers via group buy-out and buy-in annuity transactions. The chart below shows the steady growth in the Canadian group annuity market over recent years, and 2017 is on track to significantly exceed past years.

What is longevity hedging, and where did it come from?

While converting to DC plans and group annuities includes transferring longevity risk, it’s one of many risks and is not the driver behind these strategies. In contrast, longevity insurance allows DB plan sponsors to specifically target longevity risk and neutralize it by transferring the risk of plan members living longer than expected to an insurer. Under a longevity insurance contract, the plan sponsor commits to a schedule of fixed premium payments into the future, in return for an insurer taking on the risk that actual future pensioner payments may exceed the premiums, due to pensioners living longer than expected.

To date, there have been two longevity insurance transactions in Canada. In early 2015, BCE Inc. transferred $5 billion of longevity risk to Sun Life Financial, some of which was reinsured with RGA Canada and SCOR Global Life. In late 2016, the Canadian Bank Note Company, Limited executed a $35 million longevity insurance transaction with Canada Life. These transactions have helped establish longevity insurance as a proven risk mitigation tool for Canadian DB plans of all sizes.

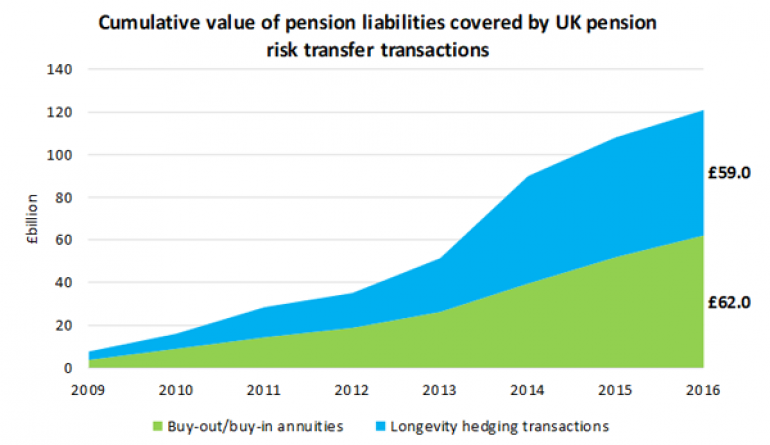

While Canada is still in the early days of managing longevity risk, the UK has seen significant growth in longevity insurance transactions – commonly referred to as longevity swaps in the UK or, more generally, as longevity hedging transactions. To date, over 40 UK DB pension plans have executed longevity hedging transactions, covering over £60 billion (or ~$100 billion) in pension liabilities.

Source: Hymans Robertson 2017 Risk Transfer Report, August 2017

So why has longevity hedging taken off in the UK? It’s widely commented that Canada’s pension industry is 5 to 10 years behind the UK’s, and it’s remarkable how true this is when it comes to pension risk management. The current de-risking trend in Canada was already well underway in the UK in the 2000s, with many plans taking steps to mitigate their investment, interest rate and inflation risk through liability-driven investment (LDI) and asset mix glide-path strategies. Then, changes in UK longevity expectations highlighted that plans hadn’t been thinking carefully enough about longevity risk. Many plan sponsors quickly realized it wasn’t a risk they wanted – primarily because there is no expectation of earning a return for longevity risk. Insurers and reinsurers, on the other hand, have very good reasons to take on longevity risk, as it can provide offsetting (i.e., diversification) benefits against the significant mortality risk they are exposed to through life insurance coverage.

Longevity hedging transactions created an elegant way to address a plan’s longevity risk gap, as such a transaction could be overlaid on a plan’s current de-risking strategy to create a synthetic buy-in annuity. A synthetic buy-in functions like a traditional buy-in. However, only longevity risk is hedged with an insurer, with the plan sponsor hedging interest and inflation risks.

Initially, UK longevity hedging was dominated by £1+ billion transactions, as sophisticated plan sponsors navigated the complexities of these new transactions to achieve a flexible and tailored solution with reduced costs compared to traditional buy-ins. However, in recent years, longevity hedging has increasingly been adopted by smaller plans, with six of the nine transactions between 2015 and 2016 covering liabilities of less than £1 billion.

Why should Canadian pension plans consider longevity insurance?

For plans that have already developed strategies to mitigate and/or manage their investment and interest rate risk, longevity risk should be top of mind. It’s a risk that impacts all DB pension plans; however, it’s less well understood to plan sponsors than other key pension risks.

Understanding and quantifying longevity risk is a critical first step. The table below outlines some key considerations that may make longevity insurance particularly appealing.

| Factors | Considerations |

| Plan size | Small plans (typically those with fewer than 200 pensioners) have very high levels of individual longevity risk – meaning that even with the best longevity assumptions, individual variations in life spans can have a significant impact.

Very large plans (e.g., $1B+) that are interested in annuitizing need to take extra time and care leading up to pension risk transfer. Specifically, building up a portfolio of assets to transfer in-kind to the insurer usually results in better pricing. Longevity insurance can help protect against longevity risk while preparing for the full transfer. |

| Pension increases | Pension increases accentuate the impact of longevity risk, as they increase the value of future pension payments. Longevity risk also builds over time, since there is more uncertainty about future changes in longevity.

Inflation-linked increases pose unique challenges for those looking to transfer pension risk. To hedge inflation risk, insurers that provide buy-outs/buy-ins invest in Canadian inflation-linked bonds (i.e., real return bonds or RRBs). However, the market for RRBs is very limited in Canada, making inflation-linked annuities very costly compared to their non-indexed equivalents. Plans with inflation-linked increases can instead use longevity insurance to hedge longevity risk and tackle inflation risk directly. |

| Cost advantages | There are several factors that could make the cost of hedging longevity risk more advantageous, including the following:

1. If a plan is currently using conservative longevity assumptions, the cost of hedging longevity risk could be quite favourable. 2. Many insurers/reinsurers have anticipated an increase in longevity insurance transactions. As a result, supply currently exceeds demand, offering the potential pricing advantages for early adopters. 3. Using longevity insurance with other risk management strategies to create a synthetic buy-in may achieve a more flexible and lower-cost risk transfer solution than a traditional buy-out or buy-in. |

| Tailored risk management strategy | Longevity insurance provides a means to explicitly target longevity risk, enabling plan sponsors of all types and sizes to tailor their strategies to their unique risk management goals and risk appetite. |

The hedging of longevity risk by Canadian DB plans is poised for significant growth in the coming years. More and more Canadian plan sponsors are investigating their longevity risk and coming to the same realizations as UK plan sponsors.

Given the time, effort and cost expended on mitigating and managing other risks, looking closely at longevity risk can help ensure it won’t de-rail your strategy – and may, in fact, be the ideal complement. Have you considered if longevity hedging is right for your plan?

This article was originally published here.