New results from Club Vita Canada: There are better ways to differentiate how long pensioners live – one of the most crucial: their postal code.

22 June 2017

TORONTO – New research on Canadian pension and post-retirement benefit plans dispels the view that public-sector pensioners live longer than their private-sector counterparts. After investigating a comprehensive set of factors to explain how long pensioners are living, Club Vita Canada – the first dedicated longevity analytics provider for Canadian pension plans and a subsidiary of Eckler Ltd. – has found that whether a pensioner worked in the public or private sector isn’t a meaningful or reliable factor.

Club Vita Canada found that by focusing on plan-level factors, such as public versus private sector, pension plans may be exposing themselves to a greater risk of incorrectly measuring the longevity of their members. For instance, based on the consolidated dataset from plans participating in Club Vita Canada, which covers more than 500,000 Canadian pensioners, Club Vita Canada found that male private-sector pensioners are living slightly longer than male public-sector pensioners. This is the opposite of current pension industry views.

The reality is, how long members of a pension plan live is a function of the members themselves, not the type of plan they are a member of.

The findings come from Club Vita Canada’s first annual and highly successful longevity study completed in 2016. This is one of the largest, most rigorous research studies on the impact of longevity on defined benefit pension and post-retirement benefit plans.

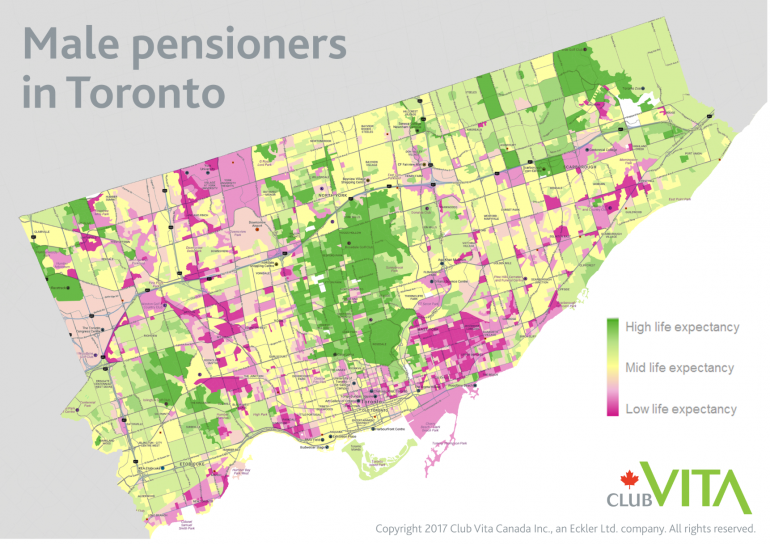

“Based on our data and statistical modelling, we’ve found that a much more accurate and reliable picture of how long pensioners are living can be captured by looking at the attributes of individuals as opposed to their plan,” explains Richard Brown, senior longevity consultant at Club Vita Canada. “Our approach allows pension plans to unlock insights into how long plan members are living. We have found that for a male pensioner age 65, we can explain a nine-year difference in life expectancy based on individual attributes like postal code – which helps to identify a pensioner’s lifestyle and socio-economic status.”

While Club Vita Canada’s approach is new for Canadian pension plans, Canadian insurance companies already employ a similar approach and are increasingly using postal codes. In the UK, postal codes have been widely used by pension plans, insurers and reinsurers for some time. “By adopting a similar approach as insurers and reinsurers, pension plans looking to transfer risk can much better assess the benefits and costs of transferring longevity risk. And by gaining better insight into how long pensioners are living today, plans can shift their attention to how life expectancies may change in the future, as it’s this future uncertainty that plans should be really focused on,” says Brown.

Club Vita Canada findings: Club Vita Canada’s average male pensioner life expectancy by dissemination area (i.e., representing populations of about 400 to 700).

About Club Vita Canada Inc. (clubvita.ca)

Club Vita Canada Inc. was created by Eckler Ltd. It is an extension of Club Vita LLP, a longevity centre of excellence launched in the UK in 2008 by Hymans Robertson LLP. By pooling robust data from a wide range of pension plans, Club Vita provides its members with leading-edge longevity analytics.

About Eckler Ltd. (eckler.ca)

Eckler is a leading consulting and actuarial firm with offices across Canada and the Caribbean. Owned and operated by active Principals, the company has earned a reputation for service continuity and high professional standards. Our select group of advisers offers excellence in a wide range of areas, including financial services, pensions, benefits, communication, investment management, pension administration, change management and technology. Eckler Ltd. is a founding member of Abelica Global – an international alliance of independent actuarial and consulting firms operating in over 20 countries.

About Hymans Robertson LLP (hymans.co.uk)

Established in 1921, today Hymans Robertson is one of the longest established independent consulting and actuarial firms in the UK. The firm offers a full range of services including the provision of actuarial, investment consultancy, administration and general consultancy services to the trustees and sponsors of defined benefit and defined contribution pension schemes, and an enterprise risk management practice advising banks and life insurers. Hymans Robertson is also a member of the Abelica Global network.

For further information:

Request a copy of our Key findings from Club Vita Canada’s first annual study of defined benefit pensioner longevity.

And to learn more about how Club Vita Canada can help you understand and manage longevity for your pension and post-retirement benefit plans, visit clubvita.ca or contact:

Richard Brown

416-696-3016

[email protected]

Ian Edelist

416-696-3067

[email protected]

For media inquiries, please contact Nancy Peppard at 416-696-3081 or [email protected].