For many members in defined benefit pension plans, monthly benefits are not only paid for as long as the retirees live, but also then paid to surviving spouses for as long as they live.

The payment of survivor benefits means there is a need for an assumption that accounts for the age of the retiree’s spouse. In Canada, the most common assumption is that male members have a spouse who is 3 years younger and female members have a spouse who is 3 years older.

This age-old ‘3-year age difference’ is the go-to assumption across-the-pond in the UK. The validity of the assumption was questioned in a recent article authored by our Club Vita UK colleague, Nikolay Yankov. His analysis shows that the simple 3-year age difference doesn’t align with reality.

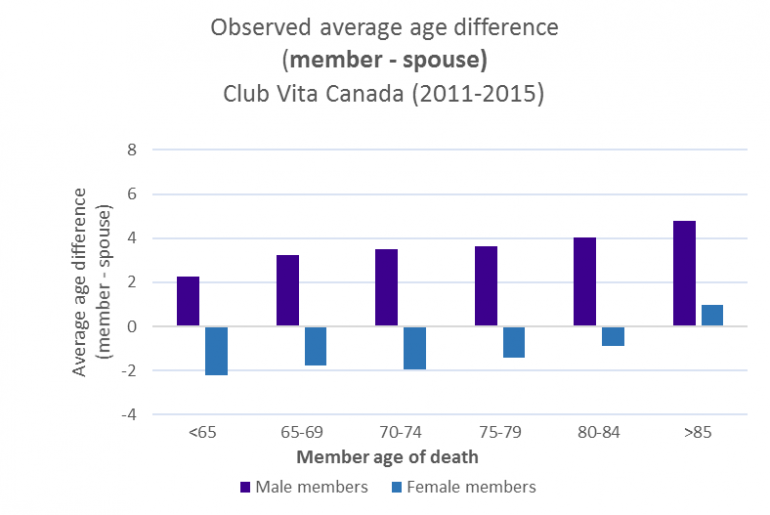

We decided to conduct a similar analysis, based on Club Vita Canada’s longevity dataset encompassing more than 600 thousand pensioners and survivors. We looked at the average age difference of new surviving spouses compared to their respective original members over the 5-year period from 2011 to 2015. The chart below shows that male members tend to be older than their spouse, while female members tend to be younger than their spouse. But, this trend has varied based on the age of the member (i.e., the original retiree) at the date of his or her death.

Consistent with Club Vita UK’s analysis, our data demonstrates a ‘survivorship bias’; that is, the younger the spouse, the greater the likelihood of the spouse outliving the original member. This explains why the results for male and female members trend upward as the original member ages (i.e., the spouses are getting relatively younger, on average, as the member ages when compared to those for the <65 category). Said another way, members having older spouses would have a higher chance of being widowed, and therefore of being excluded from the dataset used for the analysis above.

Some observations based on the chart shown above:

- For survivors who commence a pension under age 65, the age differences are consistent for males and females – approximately +/- 2 years

- Male members are consistently older than their spouses, while female members are younger than their spouses for all ages except over age 85

- The typical 3-year age-difference assumption doesn’t hold when considering the actual age differences experienced when spouses begin their survivor pension

We note that in Canada, unlike in the UK, pension plans generally know the spouse’s actual date of birth upon the member’s retirement, so typically don’t need to make an age-difference assumption. Or, an age-difference assumption is only needed for a subset of pensioners. However, an age-difference assumption is needed for those that haven’t yet retired (e.g., active members).

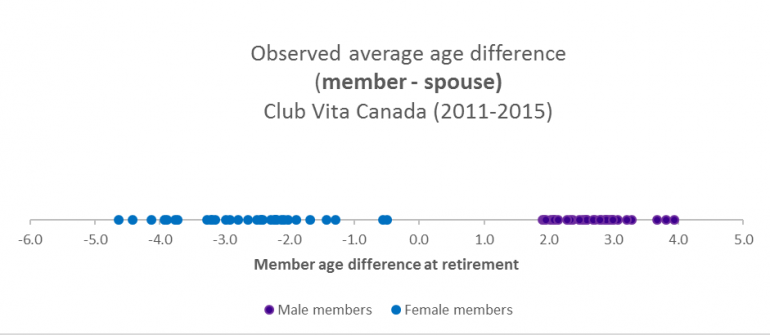

As this is the case, for those that retired between 2011 and 2015 we also looked at the average age difference between pensioners and their spouses at retirement. We found that spouses of male pensioners were on average 2.7 years younger, and spouses of female pensioners were on average 2.3 years older. So, in this case, the 3-year age difference assumptions are more closely aligned with reality; however, we found that the experience varies by plan. The chart below shows that the average age of the spouse for males is 2 to 4 years younger, while the average age of a female’s spouse is 0.5 to 4.5 years older.

The power of the traditional 3-year age difference assumption is its simplicity. However, the analysis above suggests that this assumption could really benefit from a fresh look in the context of individual plan populations.

Plans based on spouse-at-retirement survivor benefits can benefit from using their own data, where spousal information is readily available, when deriving their age-difference assumption. Whereas, plans based on spouse-at-death survivor benefits can benefit more from the information gleaned from the first chart when deriving their age-difference assumption.

Contact us

To find out more about how we can help you please don't hesitate to get in touch

Join the discussion

Our Friends of Club Vita LinkedIn group brings together like-minded individuals with a shared interest in longevity. Share insights on longevity and connect with industry peers.