In this regular column, Club Vita’s longevity experts will help you visualise the often abstract world of longevity risk by introducing some of their favourite charts.

In this edition Longevity consultant Nikolay Yankov continues on the marital theme set by the previous edition of Club Vita Top Charts and explores the age differences between pension scheme members and their spouses.

Question:

Are husbands always 3 years older than their wives?

Answer:

The short answer is no, the data reveals a trend of younger surviving spouses the older the pensioner.

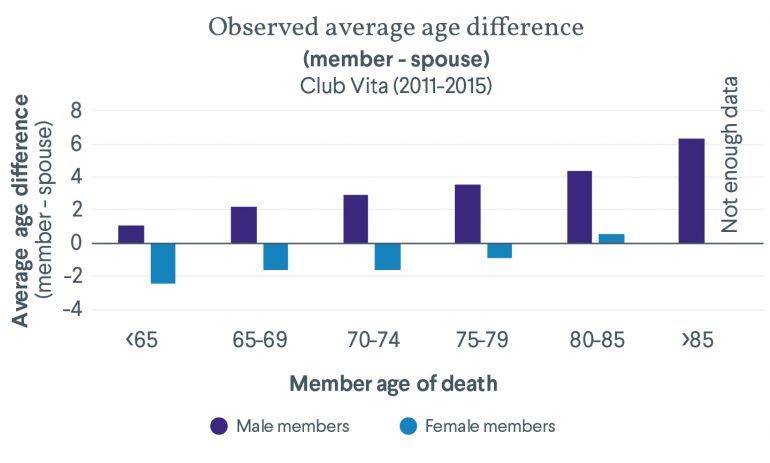

The chart below captures the average age difference between a member of a pension scheme in the Club Vita data set and their surviving spouse in the event of the member’s death*. We see that the older the member is when they die, the younger their surviving spouse. Husbands are generally older than their wives, although the age difference between member and spouse depends on whether the member is male or female.

In fact, this is a perfect example of the statistical term “survivorship bias”. As mortality increases with age, there are simply more marriages left between pension scheme members of older ages and younger spouses. Those with older spouses are more likely to have widowed and consequently get excluded from the “married” data set. Despite this survivorship bias, and their longer comparative life expectancies, female members still have a tendency to leave

surviving spouses who are older than themselves.

Key takeaways

- The older the member on death, the younger the surviving spouse.

- Husbands are generally older than their wives but the extent depends on whether the member is male or female.

- The classic 3/-3 assumption might not be the best for modelling pension scheme liabilities – but it does depend on how that assumption is used in the modelling.

We note that we are only able to capture the age difference of a surviving spouse in the event of the member’s death, and not the age difference of any existing spouse on the retirement of a member. However, it is often the former that is used when modelling liabilities.

The key question for pension schemes and insurers is: What age difference assumption do you need to capture when modelling your liabilities?

What do you think?

Please post your questions in our Friends of Club Vita discussion group on LinkedIn.

*Note that the age difference of a member and their spouse does not contribute to this average if the spouse dies before the member.

Top Charts Issue 11: Marital age differences

Download a print friendly version of this article