In this regular column, Club Vita's longevity experts will help you visualise the often abstract world of longevity risk by introducing their own personal favourite charts.

In this edition Longevity Modeller, Chuyi Yang, looks at the benefits of individual assumptions when assessing the value of longevity insurance for sub-groups of pension scheme members.

Question:

Are individual longevity assumptions really necessary when insuring pension liabilities?

Answer:

In short, yes. If you are insuring all liabilities at the same time, using a single longevity assumption for all members of the scheme may be fine. However, if you are insuring a sub-group of members, individual assumptions (built up from risk factors that capture the scheme’s diversity such as post code, pension and salary) will deliver greater confidence in making good long-term decisions.

Which members should be covered when insuring pensions? All pensioners? Older pensioners? A random sample? In the UK, a common strategy is a buy-in for members with large pensions, reducing idiosyncratic risk. In the US, a common practice is to buy-out pensioners with the smallest pensions, reducing per head costs to the scheme. Whatever method is used, schemes need to consider the demographic profile of liabilities being insured and those remaining uninsured.

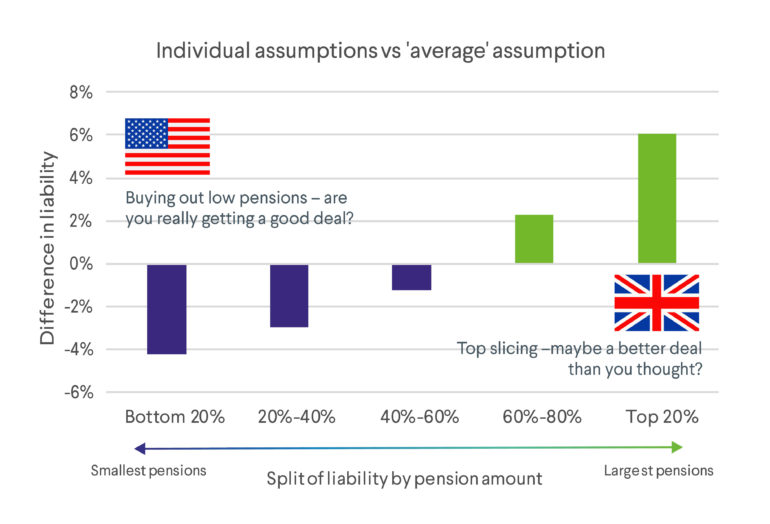

The chart below shows for a typical UK pension scheme, the differences in calculating liabilities based on a single longevity assumption that is right for the scheme ‘on average’ and longevity assumptions that are tailored to the demographic profiles of individuals, using post-codes and pension amounts to determine differences in life expectancies between individuals.

Source: Club Vita analysis 2018

Decision-makers also need to consider the uninsured risk left in the scheme. Both the average life expectancy and the concentration of risk will change depending on which members are insured. Typically, the 20% of liabilities made up of the smallest pension amounts cover c60% of pensioners. Insuring these members greatly increases the concentration of risk in the scheme, with the remaining 80% of uninsured liabilities concentrated in only c40% of members.

Key takeaways

- In general, members with larger pensions have longer life expectancies.

- Calculating liabilities using a single assumption underestimates the liability for pensioners with the largest pensions and overestimates for those with the smallest pensions.

- Take care if assessing the value of an insurance deal using a single assumption; if insuring members with the smallest pensions, the deal may not be as good you think!

Adopting individual assumptions avoids the risk of a bias, and also helps manage the risk of future buyouts being more expensive than expected.

What do you think?

If you've any comments or questions we'd love to hear from you. Get in touch via our Friends of Club Vita discussion group on LinkedIn.