In this new regular column, Club Vita’s longevity experts will help you visualise the often abstract world of longevity risk by introducing their own personal favourite charts.

In our first edition Erik Pickett shows how longevity risk for pension funds has grown as interest rates have fallen.

Interest rates and longevity risk

Question:

What is the impact of a 1-year increase in life expectancy on a DB pension fund's liabilities?

Answer:

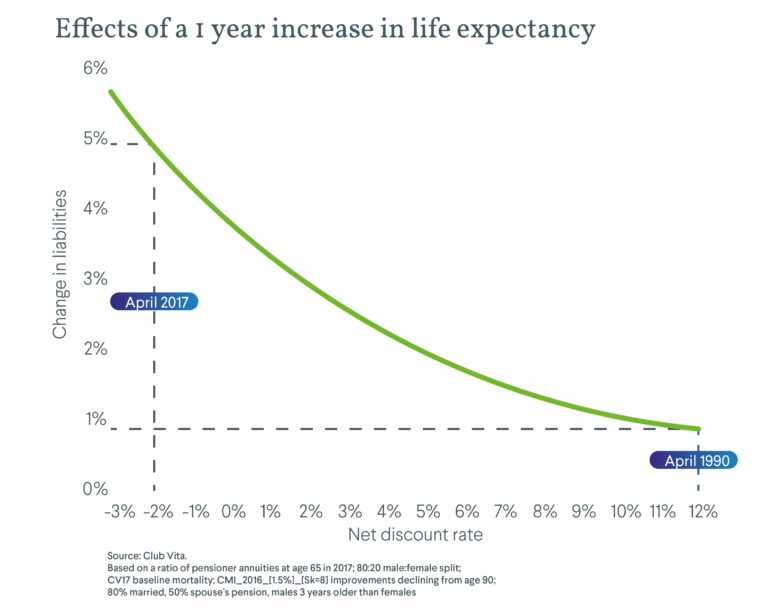

It depends on the financial assumptions being used to value the benefits in the fund. The chart below shows the change in the value of liabilities due to a one-year increase in life expectancy of a 65 year old under different assumed “net discount rates”.

Actuaries use the net discount rate to place a value on promised future pension payments (the higher the net discount rate, the lower the value of future payments). The typical benchmark for the net discount rate is the prevailing yield on government bonds less the expected future pension increases, which since 1997 are usually linked to price inflation. Net discount rates have fallen significantly over the last 25 years or so due to a combination of falling interest rates and changes in legislation.

Key takeaways from this chart

- Trustees’ stakes in longevity risk have dramatically increased as the economy has shifted to low interest rates.

- A 1-year difference in life expectancy today would have five times the effect on a pension fund's liabilities than it did in 1990!

The real question though is:

What will happen in the future?

Will pension funds continue to be open to these levels of longevity risk or will interest rates finally increase and give trustees some relief? If interest rates rise, will this be countered by increases in inflation; will caps on pension increases mitigate this effect?

What do you think? I would love to hear your thoughts. Please post your questions in our Friends of Club Vita discussion group on LinkedIn.

Top Charts Issue 1: Interest rates and longevity risk

Download a print friendly version of this article

Join our mailing list

Stay up to date with the latest news, insights, events and webinars

Join the discussion

Our Friends of Club Vita LinkedIn group brings together like-minded individuals with a shared interest in longevity. Share insights on longevity and connect with industry peers.