At a time when the number of centenarians in the UK rose to its highest ever level1, there were striking headlines in the media about falls in life expectancy. Generally speaking, if you hear or read something about life expectancy in the press, 9 times out of 10 it’ll be quoting current life expectancy at birth. The recent article by the Financial Times “UK life expectancy falls to 2010 levels (ft.com)” is one of many examples.

Whilst life expectancy at birth is a good indicator of general societal health, it’s not the most relevant statistic for retirement planning or pension scheme funding.

- It gives a lower life expectancy than appropriate for someone who has survived to retirement – that’s because life expectancy at birth incorporates the chances of dying before retirement in its calculation. Life expectancy at retirement age, in contrast, allows for the fact that someone at retirement has already survived until that age, and only incorporates the chances of dying after retirement. So, as individuals approach retirement, they should stop thinking about ‘life expectancy at birth’ and start thinking about ‘life expectancy at retirement age’.

- It doesn’t allow for the fact that we expect life expectancy to improve in the future. A ‘current’ life expectancy figure assumes there will be no changes to experience in any year in the future. However, we know that life expectancies have improved over time – on average by c1.5-2 years per decade. This means, people retiring today are expected to live longer than those who retired in the decades before them.

- It’s an average figure – even with a correct estimate, around 50% of individuals will be expected to live longer. Not a problem if you are measuring average life expectancy for a large group of people, but if you are planning your own retirement spending then you may want better odds that you will not out-survive your savings.

In addition, current life expectancy is often based on very short periods of data, so can be heavily affected by unusual periods of mortality experience – such as the COVID-19 pandemic. The recent reported drop in current life expectancy at birth is based on ONS figures2 where the most recent figure is calculated using data from 2020-2022. Figures in next year’s release, calculated using 2021-2023 data, will be expected to increase as the most severe year of pandemic mortality drops out of the calculation.

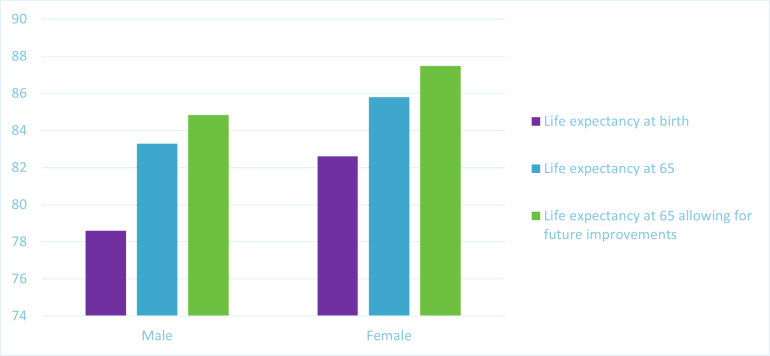

How different can the life expectancy figures be? The chart below helps illustrate this point.

Source of life expectancy at birth and life expectancy at 65: National life tables – life expectancy in the UK - Office for National Statistics (ons.gov.uk). The future improvements used to calculate the ‘life expectancy at age 65 allowing for future improvements’ figure is calculated using the CMI_2019 core model.

Current life expectancy at birth in the UK in 2020 was almost 79 for men and 83 for women. Whereas, life expectancy at age 65 allowing for future improvements was broadly 85 for men and 88 for women.

Underestimating life expectancies has financial implications:

- For pension scheme funding: when calculating appropriate funding for LGPS and other defined benefit pension schemes across the UK, underestimating a member's life expectancy by 5 years is comparable to underestimating their pension fund liability by around 20%.

- For retirement planning: if individuals with defined contribution pension pots underestimate their life span, they expose themselves to the risk of under saving, overspending and running out of money in retirement.