Pension funds have unusually long time-horizons. Their promises can be 20, 30, 50, even 80 years or more. They’re in the until-death-us-do-part business.

My latest risk graphic explains why pension funds ought to seek out long-term partnerships with life insurers, creating a more stable union to deal with the uncertainty of the long-term, than if they stay single.

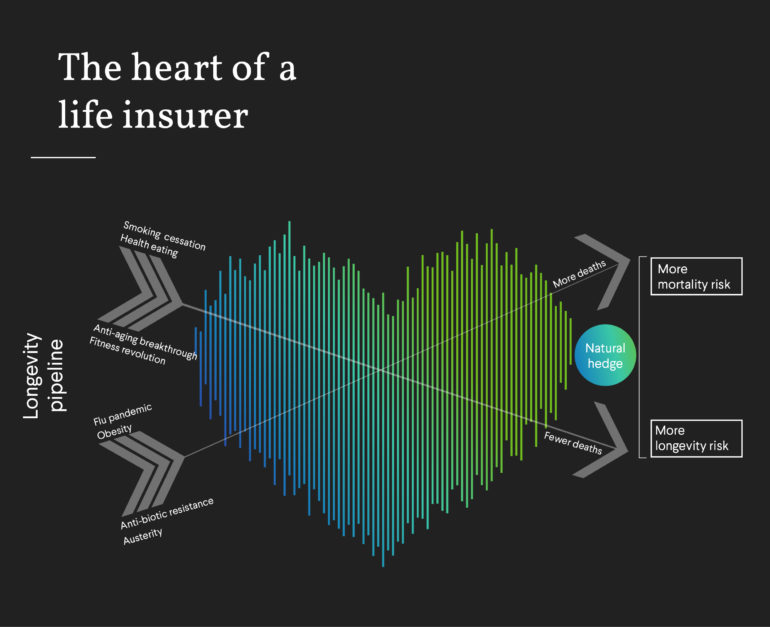

Life insurance contracts generate profits for the shareholder when policyholders live longer than were assumed when the premiums were set: the premiums are paid for longer, and the undistributed reserves earn more investment returns. The risk for the insurer is that policyholders die sooner than assumed. Actuaries, in their typically matter-of-fact way, call this dynamic “mortality risk”.

On the other hand, pension policies (annuities) respond in the opposite direction in the same future health environment: generating losses if pensioners live longer than assumed, but profit if people die sooner than assumed. This profit signature is called longevity risk.

So, at its heart, an insurer writing both life insurance contracts and annuities can achieve stability. The same drivers affect the two types of business in attractively opposite ways.

Cupid’s mortality and longevity arrows are being propelled by different forces: who will win out in the search for an anti-ageing breakthrough or the resistance of viruses to anti-biotics? No one can be sure, but pairing mortality risk off with longevity risk forms a strong, stable bond. The opposite forces in the business model create an enduring, life-long relationship to withstand the many uncertainties of the future external environment.

Pension funds can achieve the same stability by pairing up with a life insurer. Of course, in practice the dating game can be a messy business. Do both parties see the future uncertainties in a sufficiently similar way to put up any bad habits? Do you trust your prospective partner to deliver on his or her promises? And how would you react if you were asked to pay a dowry to land your Mr or Miss Right?