People have a natural tendency to underestimate life expectancy and actuaries traditionally base future projections on extrapolations of observed historical experience; this can result in institutional blind spots to extreme future longevity events. But what would happen if one of these overlooked scenarios occurred?

In an effort to avoid a sudden step-change in expectations, Club Vita’s recent Risk of Living Longer webinar series explored potential drivers of significant increases in future lifespan and health span. During this series we heard from a range of industry experts about potential areas of medical and technological research that could contribute to significant increases in longevity. If even half of the possibilities discussed are realised, they could drastically change the outlook for life expectancy currently used in actuarial circles.

In session 4, Dr Peter Joshi (University of Edinburgh, Humanity Inc) gave us an overview of biological clocks, detailing key biological markers that can be used to define a person’s biological age. An individual’s biological age can differ from their chronological age if these markers have degraded at a different rate to the average. Much of longevity science is focused on reducing biological age comparative to chronological age.

In session 2, we explored one such possibility for reducing biological age. Prof Richard Faragher (University of Brighton) discussed exciting developments in a new class of drugs known as senolytics: potential treatments aimed at reducing the impact of aging by clearing out senescent cells in the body (senescent cells are damaged cells that can no longer replicate themselves, they build-up as we age and are believed to trigger various physical signs of aging). If senolytics can replicate in humans the results they have seen in mice, it’s possible that there could be a wide-scale reduction in biological age across the population.

Prof Faragher highlighted that a possible future scenario for the population could be an increase in life expectancy at age 65 of around 10 years by 2044 (also dependent on developments from this area of research being accompanied by additional manufacturing and supply developments).

What if…?

So, what if this scenario came to fruition?

Prof Faragher’s possible scenario is an increase in life expectancy by 10 years for a 65-year-old over the next 20 years. Specifically, the mechanism would be for senolytics to slow the aging process for those over 65 to the point where they were really exhibiting the biological make-up (and therefore the mortality rates) of someone ten years younger.

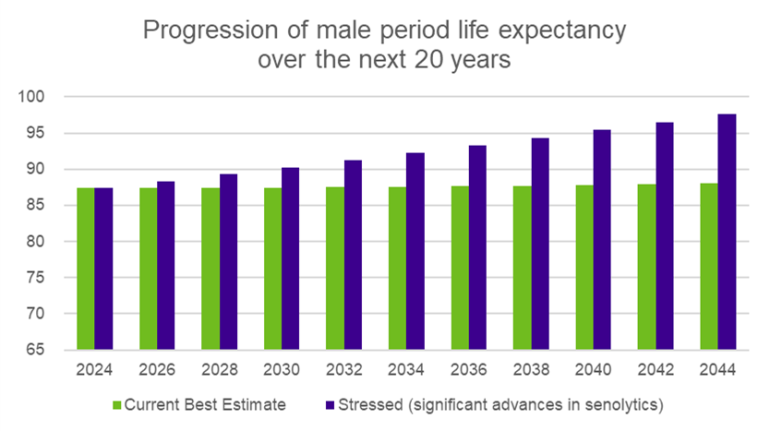

Life expectancy progression

Under current actuarial best estimates1, period life expectancy for a 65-year-old man would be expected to increase by just over half a year by 2044. Under our scenario, we would see a 20 times larger increase in period life expectancy for a 65-year-old man:

Source: Club Vita calculations assuming VitaCurves base mortality for a medium/high socio-economic male (CV23v2_1921_MPNalgGpb5), Best Estimate improvements of CMI_2023 (core) 1.25% long term rate and a stressed scenario that trends to mortality rates for (x-10) years by 2044.

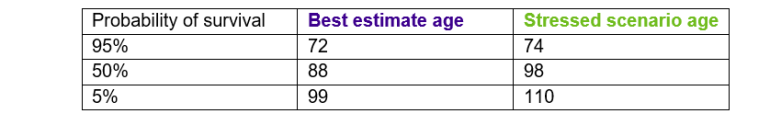

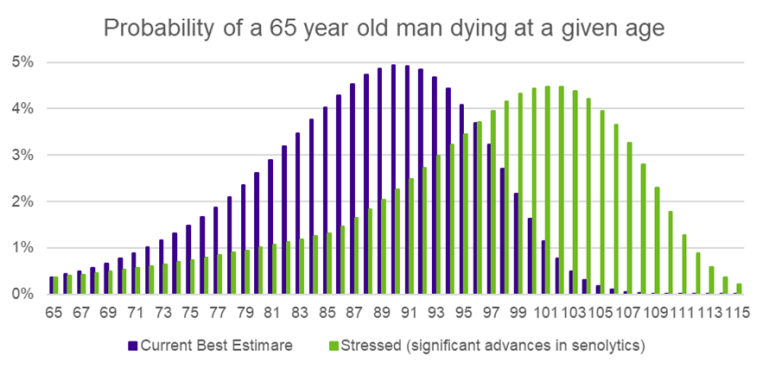

Probability of survival

Under current best estimate projections, a medium/high socio-economic 65-year-old man in 2024 has a 5% chance of living to 99, under our stressed scenario this increases to 110.

Source: Club Vita calculations assuming VitaCurves base mortality for a medium/high socio-economic male (CV23v2_1921_MPNalgGpb5), Best Estimate improvements of CMI_2023 (core) 1.25% long term rate and a stressed scenario that trends to mortality rates for (x-10) years by 2044.

Impact on reserving requirements

Remaining cohort life expectancy for a medium/high socio-economic man or woman at age 65 in 2024 increases by around 9 years (around 35%) when moving from our current best estimate improvements to our stressed scenario. This means, at a real discount rate of 0% we would expect to see liabilities increase by around 35%. At a higher real discount rate of 4%, we could still expect to see increases in liabilities by around 20%. And even at a real discount rate of 7% we’d still see increases in liabilities of over 10%.

Further considerations

The scenario presented here is one possible trajectory of outcomes following a significant breakthrough in senolytics over the next 20 years. We note that such a breakthrough could take many forms. Some further considerations around such a scenario could be:

- The timing of gains in life expectancy affecting the population (we have assumed a linear increase in life expectancy over the next 20 years, but this might instead materialise as a lagged step-change in life expectancy).

- The specific population that would be most affected by advances in senolytics (would these treatments be equally available to all socio-economic groups, would they have the same impact on groups with different starting longevity rates?)

- Is it possible for senolytics to increase maximum lifespan or would an increase in life expectancy due to senloytics have to come from increases in longevity at younger ages (given senolytics claims to tackle the aging process itself, we have assumed it is capable of increasing maximum lifespan in our scenario).

What do you think?

If many people start achieving significantly longer lifespans, there could be far reaching effects both on society and on our financial institutions. There are a number of realistic scenarios that could lead to significant increases in life expectancy. And, even if they do not represent a best estimate of the future, they should not be ignored by those managing future longevity risk. The significant advances in senolytics scenario explored here could result in increases in liabilities in the region of 25% and lead to a significant number of individuals living much longer lives. Do you think we are prepared for such a risk? If you are a holder of longevity risk (a sponsor of a pension plan or an insurer whose annuity book is not hedged against longevity), you might want to consider whether there is value in hedging longevity.

- Recordings of the first five Club Vita webinars in the Risk of Living Longer series are available here.

- To stay up to date with further episodes of the series either request to join our mailing list, or follow us on LinkedIn.

1 The figures here are calculated on typical UK assumptions, but we see similar impact on US and Canadian assumptions.

The Risk of Living Longer: What if new senolytic drugs fulfil their potential?

Download a full PDF of this article